Leading Best Bookkeeper Calgary firms every local business should consider

Wiki Article

Exploring the Key Obligations of a Specialist Accountant in Finance

The function of a specialist accountant is basic in the domain name of finance. They are entrusted with keeping precise financial records, managing accounts payable and receivable, and making sure conformity with monetary policies. Furthermore, their duty reaches preparing economic declarations and records. Each of these obligations adds to the economic wellness of an organization. The nuances of their work typically go unnoticed, elevating questions regarding the impact of their competence on more comprehensive economic strategies.Keeping Accurate Financial Records

Keeping precise economic records is an important obligation for professional bookkeepers. This task requires meticulous focus to information and a complete understanding of economic concepts. Bookkeepers are accountable for documenting all economic purchases, making certain that information is taped continually and precisely. They utilize different audit software program and devices to streamline the recording process, which boosts effectiveness and lowers the danger of mistakes.Routine settlement of accounts is important, permitting accountants to identify discrepancies and correct them promptly. By maintaining organized and current documents, they offer useful insights into the economic health of an organization. This obligation additionally includes the prep work of financial declarations, which act as a significant source for administration decision-making. Eventually, the precise economic records kept by bookkeepers sustain compliance with regulative requirements and foster count on amongst stakeholders, thereby adding to the overall success of the organization.

Taking Care Of Accounts Payable and Receivable

Successfully taking care of accounts payable and receivable is a vital element of a bookkeeper's duty, assuring that an organization's capital continues to be healthy and balanced. This obligation entails tracking incoming and outward bound payments, which enables for timely payment and collections from customers while additionally ensuring that the organization fulfills its economic responsibilities to suppliers and distributors.

Accountants need to keep precise records of billings, payment terms, and due days, facilitating reliable communication with lenders and clients. By checking these accounts, they can recognize discrepancies or overdue accounts, allowing positive measures to deal with concerns before they rise.

Additionally, an accountant's role includes fixing up accounts to guarantee that all monetary transactions line up with financial institution statements and internal records. This persistance not only enhances financial transparency however additionally supports critical financial preparation, permitting the company to allocate resources successfully and preserve a durable financial placement.

Making Sure Conformity With Financial Laws

While steering through the complex landscape of monetary laws, a bookkeeper plays an essential duty in guaranteeing a company sticks to lawful criteria and guidelines. This obligation includes remaining upgraded on modifications in tax obligation laws, conformity needs, and industry-specific laws. Best Bookkeeping Calgary. By carefully tracking economic transactions and maintaining exact records, the bookkeeper helps protect against offenses that might result in charges or legal issuesFurthermore, the bookkeeper keeps an eye on inner controls to guard versus fraudulence and mismanagement. They carry out procedures that promote openness and liability within the economic structure of the company. Cooperation with auditors and governing bodies additionally solidifies compliance efforts, as accountants supply necessary documentation and support throughout evaluations.

Ultimately, the dedication to compliance not just safeguards the organization however also improves its reputation with stakeholders, fostering trust and stability in its monetary methods.

Readying Financial Statements and Information

Preparing economic declarations and reports is an important job for bookkeepers, as it provides stakeholders with a clear summary of an organization's economic health and wellness. Bookkeeper Calgary. These files, which usually consist of the annual report, earnings statement, and capital statement, summarize the financial tasks and position of the company over a specific duration. Bookkeepers thoroughly collect, document, and organize monetary data to ensure precision and compliance with applicable accountancy standardsThe preparation process entails resolving accounts, confirming transactions, and changing entries as required. With this complete method, bookkeepers help guarantee that financial declarations show truth state of the organization's financial resources. In addition, prompt preparation of these records is crucial for reliable decision-making by administration, financiers, and regulatory bodies. By providing precise and clear financial paperwork, bookkeepers play an important duty in keeping openness and count on within the economic ecological community of the organization.

Providing Financial Insights and Evaluation

Bookkeepers examine financial information to provide useful understandings that educate critical decision-making within a company. By carefully evaluating trends in revenue, expenditures, and capital, they aid identify locations for enhancement and emphasize possible threats. Bookkeeping Services Calgary. These understandings enable administration to designate resources much more properly and adjust company techniques as necessary

In addition, by leveraging monetary software program and analytical devices, accountants can offer data in a comprehensible and clear layout, making it much easier for decision-makers to understand complex economic concerns. Ultimately, the understandings stemmed from a bookkeeper's analysis encourage organizations to make educated selections that enhance profitability and drive growth.

Often Asked Concerns

What Software Application Equipment Do Specialist Accountants Normally Utilize?

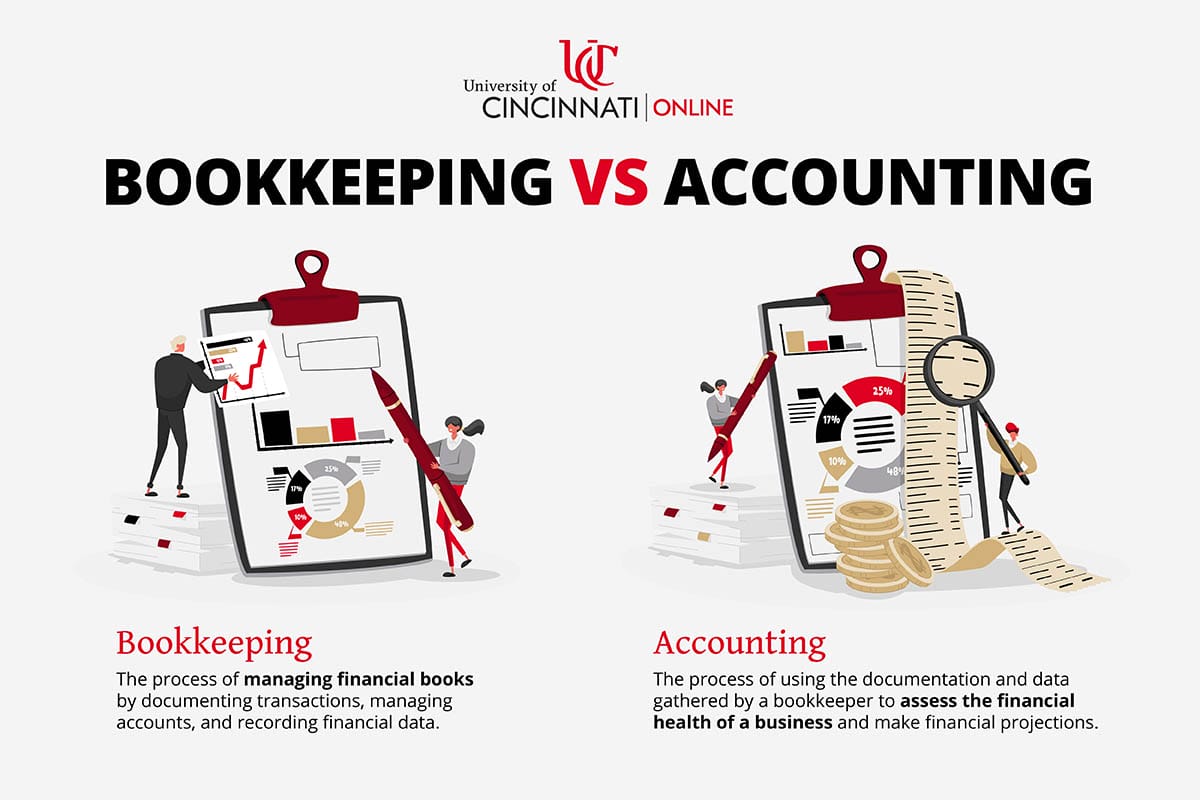

Expert bookkeepers normally utilize software application devices such as copyright, Xero, Sage, and FreshBooks. These applications streamline financial administration, facilitate exact record-keeping, and enhance reporting capacities, permitting efficient handling of financial purchases and information analysis.Exactly how Does a Bookkeeper Differ From an Accounting professional?

An accountant primarily manages daily monetary purchases and record-keeping, while an accounting professional evaluates monetary data, prepares declarations, and offers critical suggestions. Their functions match each other however concentrate on unique aspects of monetary administration.What Credentials Are Called For to Come To Be an Accountant?

To end up being an accountant, individuals typically call for a secondary school diploma, effectiveness in accounting software program, and understanding of basic audit concepts. Some might go after certifications or associate levels to improve their credentials and job leads.How Typically Should Financial Records Be Updated?

Financial records need to be upgraded consistently, preferably on a once a week or everyday basis, to ensure accuracy and timeliness. This practice check here permits for reliable monitoring of monetary tasks and sustains informed decision-making within the organization.Can an Accountant Assist With Tax Obligation Prep Work?

Yes, an accountant can aid with tax preparation by organizing monetary documents, guaranteeing precise paperwork, and supplying needed records. Their proficiency helps improve the procedure, making it much easier for tax obligation professionals to complete returns efficiently.They are entrusted with maintaining exact economic records, taking care of accounts receivable and payable, and ensuring conformity with financial laws. Preparing economic declarations and reports is a critical task for accountants, as it provides stakeholders with a clear overview of a company's financial health and wellness. With this thorough strategy, accountants help assure that monetary declarations mirror the real state of the company's funds. By leveraging financial software and analytical devices, accountants can present information in a clear and understandable format, making it easier for decision-makers to grasp intricate financial concerns. A bookkeeper mostly takes care of everyday economic transactions and record-keeping, while an accounting professional assesses economic information, prepares declarations, and supplies strategic recommendations.

Report this wiki page